Online Home Market Analysis

The Online Home Market Analysis is an evaluation of the property supply by Immoscout24 in collaboration with the Homeowners Association and the Swiss Real Estate Institute. The period observed in each year is between the third quarter of the previous year and the second quarter of the following year.

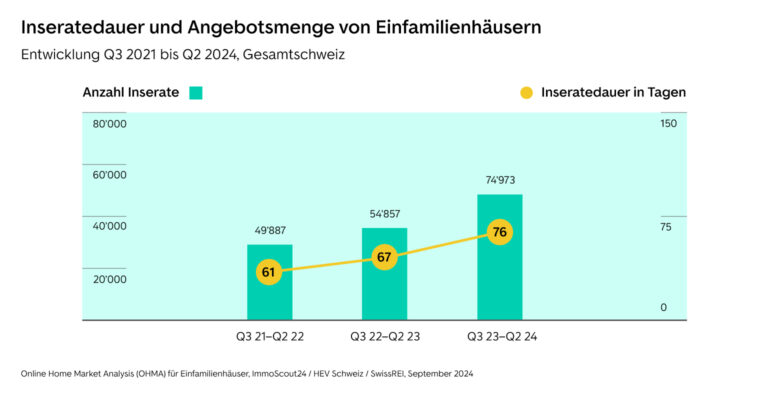

Further increase in the number of listings – albeit at a slower pace

In the 2023/24 period under review, there was a massive increase in the number of single-family homes advertised compared to the same period in the previous year, with a marked rise of 36%. In the previous period, there were again more single-family homes advertised, but to a lesser extent (+ 4%). An upward trend can also be observed in the duration of advertisements throughout Switzerland, with detached houses currently online for an average of 79 days.

Prospective buyers more selective – high-quality sales documents are crucial

For market participants, this means that buyers tend to take a little more time and have become more selective as they have more choice. For sellers, the importance of a well-thought-out marketing strategy with highly professional sales documentation and a contemporary presentation of the property is increasing. Thanks to the continuing very good demand, the price level remains stable, although there are signs of consolidation on the market for detached houses.